The state of “globenomics”, a term I first heard from trends forecaster Gerald Celente, who I highly respect and recommend people interested in knowing about what is likely to happen with their money, economy, politics and everything that really matters in life, to check out, is fantastic! In La La land. Or for someone brainwashed into believing bad economics by “the experts” who, between revolving through the doors of corporations, don’t hesitate to make their fair share of visits to media establishments and regurgitate the “state narrative”, which is simply a clever way of saying that they are “bought and paid” for.

In reality, however, the best way to describe the state of globenomics is “ugly”. No matter who you are, if you do not belong to the global top 1 per cent (getting closer and closer to 0.1 per cent) than it does not look good for you. Not even on the surface. Yes parts of the global stock market are hitting all time highs. But stock markets are bad indicators to go by in judging the state of globenomics. Yes we are seeing astronomical house prices also in some parts of the world. But history teaches us that these are all bubbles. And as bubble gums should have taught us, a bubble can only last so long before bursting on your face.

Similarly, you can find fallacies in pretty much all the arguments repeatedly spewed out by the bought and paid for experts to support their claim that the global economy is doing great and that we should all go back to watching American Idol, or Bangladeshi Idol, or whatever else that can take our attention away from things that affect us every single day of our lives, if not our entire life, and of those that matter to us. To keep us believing an illusion, as belief in the illusion, in itself, is part and parcel in maintaining it. Because as one thing economists will tell you, is that confidence massively effects the economy.

You might believe that if you do not live inside the United States, this has no bearing on you. But you would be wrong, again. The dollar is both the world reserve currency and the only currency using which, oil is sold on the global markets, giving it the “petro-dollar” status. Meaning, that wherever you live, whether your country is an oil exporter or importer, you are affected

Another thing that greatly effects the economy is, of course, finance. Especially the Western financial system, and why it does, I will explain shortly.

But before that, let me quote Dr Paul Craig Roberts, former Assistant Secretary of the Treasury for Economic Policy in the US under President Ronald Reagan and associate editor of the Wall Street Journal, “The extent of financial corruption involving collusion between the mega-banks and the financial authorities is unfathomable. The Western financial system is a house of cards resting on corruption…. [which] has stood longer than I thought possible.” And former World Bank staff and extensive writer Peter Koenig:

“Our western monetary system is based on debt and has all the hallmarks of a failing global monster octopus…. If and when the banks within this web of debt begin recalling their outstanding liabilities, they may set a non-stoppable avalanche in motion – leading to a chaotic end of the system. This end-run may have just begun. We have seen a gradual build-up since the end of WWII…. a high point with the manufactured sub-prime crisis of 2007/2008/2009, prompting an artificial and endless global economic crisis which may come crashing down in 2016/2017…. The damage may be humongous, leaving behind chaos, poverty, famine, misery – death.”

So, with all this fuss about the Western financial system, let me explain to you one core aspect of it. How money works. Before that, let me tell you that I went to what was then, supposedly, one of the best business schools in the world, doing one of the most specialised and renowned degree that they had. Yet, for all the specialisation in finance and economics that it offered, and all the details on how we use money, what they never taught us was how money is created. For that, I had to look elsewhere. And that is part of the reason why some financial commentators mislead the public.

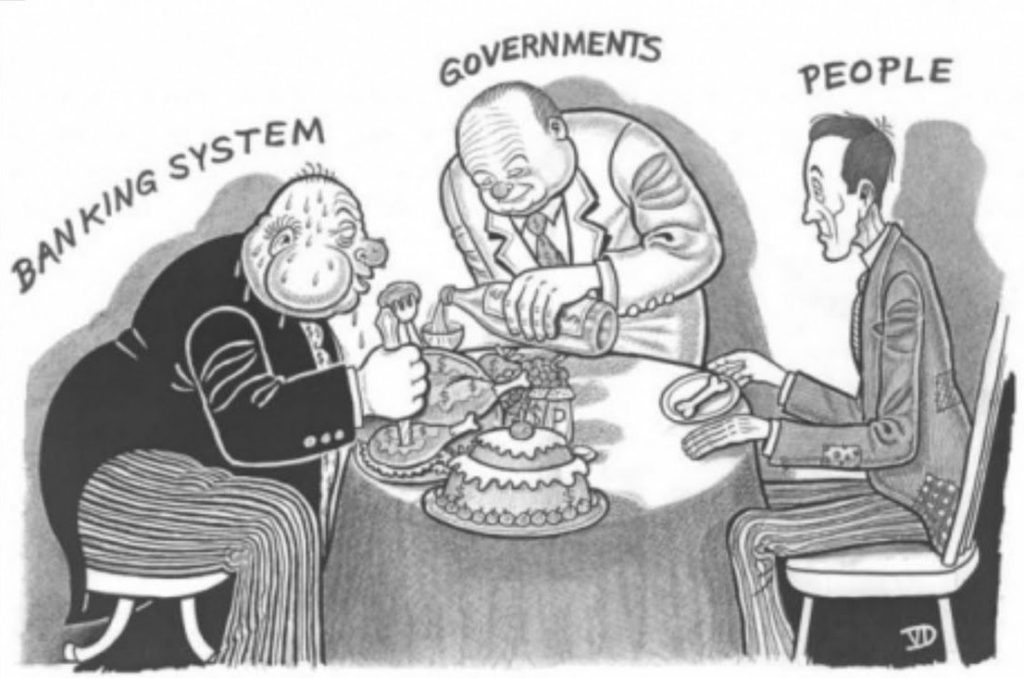

Because they themselves don’t really know. That is why most people around the world today cannot see that they are merely slaves to a system. A system controlled by the elites, for the elites. This slavery, however, is not the crude and primitive slavery of ancient times. You don’t need whips and shackles to maintain it. It is enforced using much more sophisticated methods. And by the looks of how little the slaves seem to notice their enslavement, one can easily see its effectiveness.

The accumulation of money is an accumulation of social and psychological power in a world where it has become a symbol of status and power. Those who control the creation of money, wield that power and its source. As Nathan Rochschild said during the height of the British Empire, “I care not what puppet is placed upon the throne of England to rule the Empire on which the sun never sets. The man who controls Britan’s money supply controls the British Empire, and I control the British money supply”. So who controls the Western money supply today? Well, in America, as shocking as it may be, it is not the government. Whether people know it or not, the Federal Reserve, is not a government institution. It is owned privately by a cartel of the world’s most powerful banks. But to really appreciate what that means, one must understand how the banking system really works.

Every dollar in circulation is loaned into existence by a bank. The process begins with the Federal Reserve loaning money to the US government and other entities. But the Fed isn’t loaning money that they actually have. They are merely typing dollars into existence on a computer screen. If you believe it is backed by anything physical, such as gold, you are mistaken. The Fed has not owned any gold, allegedly, since the 1930s. As Mr Koenig writes, “What does ‘fiat’ mean? It is money created out of thin air. It has no backing whatsoever; not gold, not even the economic output generated by the country or countries issuing the money, ie the United States of America and Europe. It is simply declared ‘legal tender’ by Government decree.” When the Fed loans money to the US government, it receives government bonds — written promises to pay back the money that was loaned with interest through taxation — in exchange.

So, the government is taking loans from a bank that is creating the money out of thin air and expecting you, the taxpayer, to cover that loan with interest. The absurdity of it becomes clearer when you realise that up until 1913 when the creature from Jekyll Island — the Federal Reserve — was created, the US government created its own money. And, thus, there was no need for a bank to play the role of a middle-man. Another aspect of money creation that is contrary to popular belief is that the majority of money in circulation — about 70 per cent — is not actually created by the Fed, but by ordinary banks that people use for various purposes. Because like the Fed itself, ordinary banks too, are allowed to loan money that they don’t have.

There are, of course, some restrictions. Such as the fact that banks are only allowed to loan out 10 times the amount they have. So here is the real question. If all the money in circulation is created by loans, where does the money meant to pay the interest come from? The money to pay the interest doesn’t exist. It never has and never will. This would be obvious if there was just one loan issued, but when done on a global scale, it remains hidden and turns into a game of musical chair, where the person or nation ending up without a chair when the music stops faces bankruptcy and financial decimation.

As Nathan Rochschild said during the height of the British Empire, “I care not what puppet is placed upon the throne of England to rule the Empire on which the sun never sets. The man who controls Britan’s money supply controls the British Empire, and I control the British money supply”

All the while, the interest ensures that there is always more debt than money in circulation. Because every dollar in existence is tied to a debt, it creates an unseen force that, like gravity, pulls all the money back towards the banks. Thus, every hour that you work to pay back that loan or to pay income tax, is an hour you actually worked for the banks. Once you understand that the money that the banks loans out is not actually an asset but is, in fact, a piece of legal fiction, it should be obvious that you are working for the banks for free and, thus, are a slave. And, even with all these massive financial advantages, if the banks ever do manage to get themselves into trouble, it is you, the taxpayer, who will be forced to bail them out. So no matter what, “the banks always win”.

You might believe that if you do not live inside the United States, this has no bearing on you. But you would be wrong, again. The dollar is both the world reserve currency and the only currency using which, oil is sold on the global markets, giving it the “petro-dollar” status. Meaning, that wherever you live, whether your country is an oil exporter or importer, you are affected. For example, if your country is an oil importer, you are affected by the fact that to keep your country running, you will have to acquire dollars. And to acquire those dollars, you have to send goods and services to the US or to someone else who did. Thus, you too are a slave to the bankers and their manipulative system.

Likewise, if your country is an oil exporter, you are affected by the fact that your country sends that oil to the US in exchange for this debt-based money — exchanging something of real and tangible value for digits on a screen. And if, for some reason, the leadership of your country tries to move away from the American dollar, you will quickly find her army on your doorstep, ready to deliver a fresh dose of democracy, as Iraq learned the hard way, when they switched their oil sales to Euros in 2000, and Libya did, when they tried to establish a gold based currency for Africa.

Debt based money is a masterpiece of social engineering — the ultimate tool of the ruling elite. And yet, in reality, the whole thing is nothing more than a construct of belief. Our chains are chains of the mind. Thus, the path to freedom must also begin in the mind. If we want a better future for humanity, we must seek to awaken our fellow humans to that fact. And we must understand the workings of our invisible chains, before we can set ourselves, as well as our fellow humans, free from them. For those who wish to tread down that path — the path to human freedom — I urge you to share this article far and wide. As Lao Tzu said, “the journey of a thousand miles begins with one step”.